Here Are The Latest And Greatest ETFs For High Yields

The rapid growth in the number of ETFs employing option strategies to generate high yields for investors has caused a lot of fund sponsors to try a wide range of option strategies and tactics. Of these, the so-called zero days to expiration (0DTE) strategy seems to show a lot of promise.

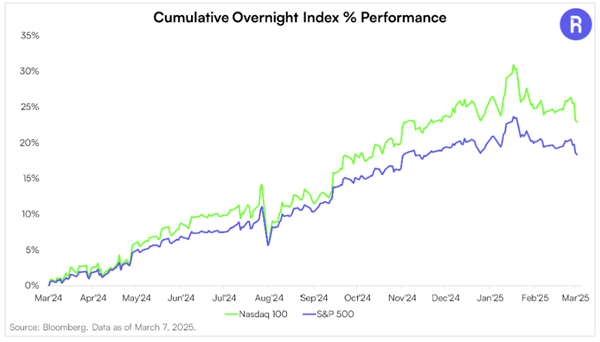

The first 0DTE ETFs launched just over a year ago, in March 2024. They do not yet have much of a track record. The recent fast and furious bear market threw returns deep into the negative. It will be a good test of these new ETFs to track the returns as the market recovers and moves to new highs.

Zero days to expiration trading involves selling calls in the morning that expire that afternoon. The options used are weekly issues, where traders make trades on the final day of the designated week. Only three securities have weekly options that trade every day. They are:

- SPDR S&P 500® ETF (SPY)

- Invesco QQQ Trust ETF (QQQ)

- iShares Russell 2000 ETF (IWM)

All 0DTE ETFs will have one of these funds as the underlying asset.

Roundhill Investments launched the first 0DTE ETFs in March 2024. The first two were the S&P 500® 0DTE Covered Call Strategy ETF (XDTE) and the Innovation-100 0DTE Covered Call Strategy ETF (QDTE). Later in the year, they launched an IWM covered call fund. (As a note, I am staying away from small cap covered call funds at this time.) XDTE and QDTE yield 24% and 35%, respectively.

YieldMax jumped on the 0DTE bandwagon, launching the YieldMax S&P 500 0DTE Covered Call Strategy ETF (SDTY) and YieldMax Nasdaq 100 0DTE Covered Call Strategy ETF (QDTY) in early February 2025.

Over the two months since the YieldMax funds launched, returns between them and the Roundhouse funds have been very comparable.

The significant benefit of 0DTE covered calls is that the funds avoid being on the wrong side of big overnight moves in the stock indexes. A recent report from Roundhouse discusses the “night effect, ” a phenomenon where stock returns have historically been higher during the overnight trading session compared to the daytime market hours.

These ETFs pay yields in the 20% to 30% range and provide more safety than ETFs writing weekly or monthly call options. The main limitation is the small number of available underlying ETFs.

This post originally appeared at Investors Alley.

Category: Dividend Yield