Recession-Proof Stock With 60+ Years Of Dividend Growth

It’s been a terrible two weeks for investors.

At one point, the S&P 500 was down over 20% from its highs, which is bear market territory.

Why the drop?

Trump’s tariff announcement sent shockwaves through the markets.

There are fears these tariffs will cause a recession in the United States.

Certainly not what Trump had in mind!

If a recession hits, we, as dividend investors, need to be prepared. While Dividend stocks are normally a safe haven in times of turmoil… that doesn’t mean we can’t take advantage of the fear to pick up some bargains.

One way to survive a recession is to purchase Consumer Staples stocks.

These are your grocery stores, food producers, household products, etc.

Essentially, products people need to survive.

Even in a recession, people still need to eat and keep themselves clean!

While Consumer Staples fell, they didn’t fall nearly as hard as the overall market.

Nobody likes losing a lot of money in the stock market!

Consumer Staples can help buffer the downward momentum.

And you know what? Most Consumer Staples stocks pay dividends!

Which brings us to Colgate-Palmolive (ticker: CL), a $70 billion household products company.

Colgate-Palmolive sells products ranging from toothpaste and personal care products, like deodorant and hand soap, to pet food and cleaning supplies.

I don’t care how bad the economy gets, I am still brushing my teeth and washing my hands!

Do you know what else is so great about Colgate-Palmolive?

They’ve been paying dividends every year since 1895.

That includes the Great Depression, two World Wars, and the Great Recession!

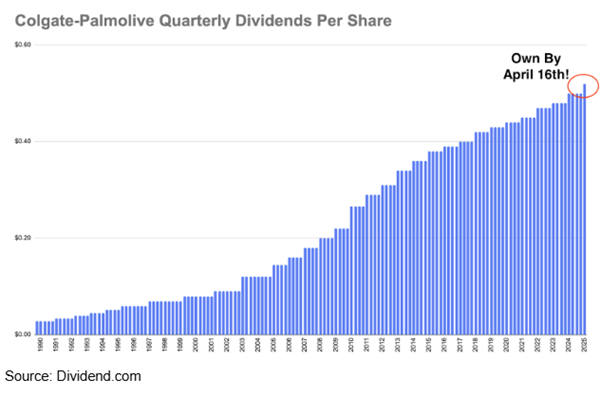

Not only that, Colgate-Palmolive has increased those dividend payments every year for over 60 years!

And Colgate-Palmolive just increased their dividend to $0.52 per share!

Its next payment is right around the corner.

If you buy Colgate-Palmolive by April 16th, you’ll collect their next payment.

How much is Colgate-Palmolive growing their dividend?

The chart only goes back to 1990 (yes, 35 years), but you can see the consistent growth.

The April payment is 4% higher than their last payment.

It’s not a huge increase, but it will outpace inflation.

The main downside to Colgate-Palmolive is its low dividend yield of only 2.3%.

Other companies will have higher dividend growth and/or higher dividend yields.

But none of them have been paying dividends for 130 years!

Are you worried about Trump’s tariffs causing a recession? If so, doesn’t a company like Colgate-Palmolive sound like a safe dividend stock?

Let me know what you think!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?