Tech Stocks With A Nearly 10% Yield? Tell Me More!

Tech is all over the news. AI, self-driving cars, space exploration, and crypto seem to be the only thing people are talking about!

It’s the same tech companies over and over again Nvidia, Tesla, Meta, Google, Amazon… the list goes on!

You know the biggest issue I have with tech stocks?

They don’t pay dividends.

Luckily, there’s a solution and it’s brought to us by J.P. Morgan.

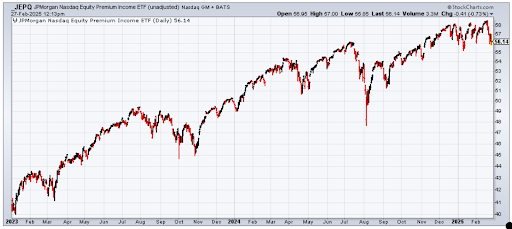

The JPMorgan Nasdaq Equity Premium Income ETF (ticker: JEPQ) is the answer to our prayers.

JEPQ invests in the 100 largest tech stocks traded on the NASDAQ.

They have a dividend yield of just under 10%! Even better, JEPQ pays out these dividends every month.

And you know what else? The price of JEPQ is up almost 40% since the beginning of 2023.

Throw in dividends and investors are up almost 75% over the last two years!

How does JEPQ do it?

JEPQ sells call options on those top 100 tech companies in the NASDAQ. They are running a simple Covered Call strategy to juice their returns.

What are call options?

Here is a quick introduction:

Call options are a promise made by investors to sell their stocks at a certain price to another investor at a later date. The sellers of call options receive a payment (called a premium) to sell the option.

Here is an example.

Let’s say I own 100 shares of Nvidia, which is trading around $120 per share. I could sell a call option to another investor to agree to sell my shares of Nvidia at $135 about a month from now.

Right now, the premium on that call option is around $2.25. The premium is the money I get for selling the call option on Nvidia.

If a month from now Nvidia stock is trading below $135… I keep the premium and the 100 shares.

If the stock is higher than $135 then the other investor will buy the 100 shares for $135.

Selling call options like the example I just went over for Nvidia is what JEPQ is doing. But they’re doing it for the 100 largest tech stocks…not just Nvidia.

The premiums JEPQ collects are being paid out to investors like you and me as dividends every month.

The dividends from JEPQ are great…but there is a downside.

Let’s go back to the Nvidia example. I am collecting $2.25 to agree to sell Nvidia at $135 a month from now.

That’s a great trade if the price of Nvidia stays below $135. However, if it rises above $135 I am losing out on those gains.

If Nvidia doubled I would be losing a lot of those gains!

The same thing can happen to JEPQ.

If tech stocks rise quickly the price of JEPQ will go up. But JEPQ won’t go up as much as the tech sector because it is capped by that call option that was sold.

Does it matter? I don;t think so, you are giving up some potential price gains to get fat dividend payments from JEPQ.

If you care about dividends then that’s a trade-off you’re willing to make.

Alot of people love this investment. JEPQ has over $23 billion in investors’ money… Making it one of the most popular dividend ETFs around!

What do you think? Is JEPQ a slamdunk ETF for dividend investors?

Or are there other dividend investments that you like better?

If you know of something better – email me back and let me know!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?