Covered Call ETFs And 0DTE Options

If you’re seeking regular income from your portfolio, sometimes using a blended investment strategy can make all the difference in the world.

There’s a new strategy I’m going to share with you in a moment…

But first, think about “Normal” passive income sources. Historically, if you wanted to capture income you’d be told to focus on bonds. They provide regular income and are historically lower risk.

Some investors, willing to take on a bit more risk, will add dividend stocks to their portfolio, for income.

However, there is a new source of regular passive income that you can capture…

Covered call ETFs are popular among income-focused investors because they offer a relatively simple way to generate cash flow.

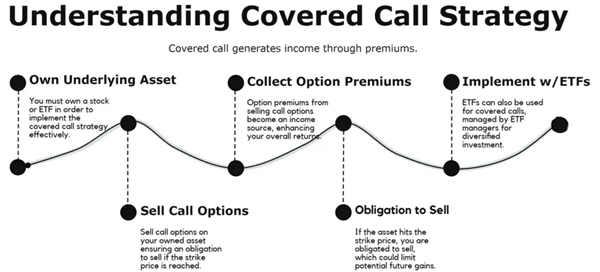

A covered call strategy involves owning an underlying asset, like a stock or an ETF, and selling call options against it. You now have an obligation to sell the underlying asset if it reaches the strike price. By doing so, you collect premiums from option buyers.

With a Covered Call ETF, the ETF manager buys a basket of stocks and then sells options against it.

The income from those option premiums goes right to the shareholder.

The appeal of covered call ETFs lies in their automated nature. Investors don’t have to handle the intricacies of writing call options themselves. The fund managers handle everything.

While covered call ETFs provide steady income, they do cap upside potential.

If the price of the underlying asset surges beyond the strike price you won’t fully participate in that price appreciation.

Regardless, covered call ETFs are a great way to generate steady passive income.

Now let me introduce something new…

0DTE Options

0DTE options are options contracts that expire on the same day they are traded.

The main attraction of 0DTE options is their rapid time decay—also known as theta decay. As options get closer to expiration, their value erodes quickly.

For income-seeking traders, this accelerated time decay presents an opportunity.

By selling 0DTE options, particularly when volatility is high but price movements are expected to be minimal, traders can pocket large premiums.

The faster an option expires worthless, the faster you can put that premium in your pocket.

0DTE options are an efficient way to generate daily income.

Now, what happens when you combine the two…

New Strategy: Combining Covered Call ETFs and 0DTE Options

By combining covered call ETFs with 0DTE options, investors can diversify their income sources and capture frequent returns in various market conditions.

To put it bluntly, you’ll make more money!

Covered call ETFs already generate monthly or even weekly income through option premiums, but adding 0DTE options trading can complement this by capturing additional short-term income.

For example, an investor holding QYLD or JEPI can collect monthly distributions from the covered call strategy, while simultaneously trading 0DTE options on the same or different ETFs!

| QYLD | JEPI |

|---|---|

| Global X NASDAQ 100 Covered Call ETF | JPMorgan Equity Premium Income ETF |

| NASDAQ-100 index | U.S. large-cap stocks |

| Covered call strategy on NASDAQ-100 | Stock selection with options overlay |

| For High income with some capital appreciation | For Consistent income with reduced volatility |

| Monthly Distribution | Monthly Distribution |

| Income-focused investors | Income-focused investors |

The covered call ETF provides a consistent, lower-risk income stream, while the 0DTE options allow for short-term income opportunities from the daily fluctuations in the market.

Combining these strategies works especially well in markets with low to moderate volatility. The covered call ETFs are designed to thrive in a range-bound environment, providing income while protecting against sudden market declines.

Meanwhile, 0DTE options take advantage of day-to-day market movements, allowing traders to collect premiums from the rapid time decay.

The best part is, that this additional trading strategy can add significant value to your overall portfolio.

Who Can Benefit from This Strategy?

The combined strategy of covered call ETFs and 0DTE options is ideal for income-focused investors. Retirees, active traders, or individuals looking for passive income streams will find this approach very appealing.

Another advantage is time.

This strategy is perfect, for investors without a lot of time, but comfortable trading options. Structured properly trades like this can be managed in less than 5 or 10 minutes a day.

It’s a great way to create both passive and active income without overcomplicating your portfolio.

Want More…

How to SUPERCHARGE Your ETF Portfolio

If you’re going to manage and supercharge your own ETF portfolio, I think you need to focus on both income and growth. But, not everyone knows how to do that in today’s crazy market.!

To help, we’ve decided to host a free webinar all about generating both PASSIVE INCOME and ACCOUNT GROWTH, in just minutes with covered call ETFs.

Click here to join our “LIVE CASH FLOW WORKSHOP”

We’ll be introducing “The ETF Income Accelerator: 5 Minutes to Weekly Payouts and Lasting Leveraged Growth”

In this webinar, we’ll show you how to generate passive income + account growth in 5 minutes per week.

The workshop is October 30th, at NOON Eastern time / 9 AM Pacific time.

Click here to sign up for free.

This post originally appeared at NetPicks.

Category: Other Useful Information