This 8.9% Dividend Soared 178% (And It’s STILL Cheap)

You may have noticed that since the pandemic, there’s been a somewhat perverse desire to make the economy look worse than it is.

Whether it’s concerns about a looming recession—the so-called “vibecession” we talked about last week—or worries that life is getting too expensive because of inflation, there’s a growing bias toward doom-and-gloom.

Plus, pessimistic people tend to sound serious—and for many pundits, parroting these arguments is easier than actually analyzing data.

At CEF Insider, we remain 100% data-driven, for the simple reason that it’s profitable. After all, the doom-and-gloom was at a fever pitch in late 2022, and we all know how stocks have done since.

Strong Gains for Data-Driven Buyers

(As we’ll discuss below, there are two CEFs that benefit from the disconnect between the media narrative and the real facts, including an 8.9% payer that’s cheap now). And we’ve got yet another data point that pushes back against the doom-and-gloomers: Workers in America are doing really well.

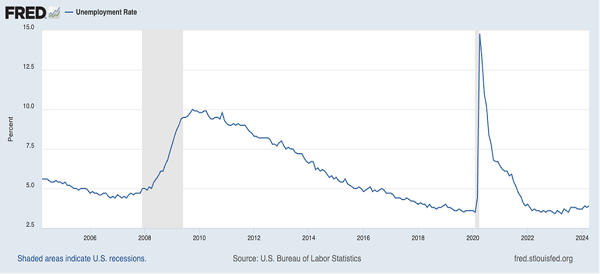

Employment Remains Strong

America’s 3.9% unemployment rate is historically very low, and it’s the opposite of what one expects in a recession, so this alone belies the argument that we’re in a “vibecession.”

In fact, the “vibecession” is probably more the result of a growing number of job losses in sectors like media, technology and finance (those that tend to capture the attention of the media, in other words!). But for the folks who do the physical work on the ground—the nurses, shopkeepers, police and others who were rightly called “essential” during the pandemic—demand hasn’t decreased at all.

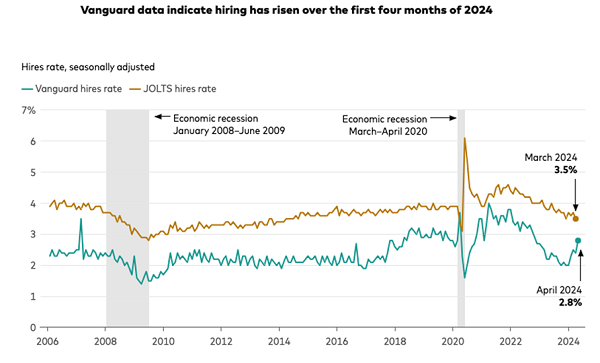

This isn’t just “vibes,” either. A recent study by Vanguard has shown that hiring is increasing for blue-collar workers, including those lower on the income scale.

If you’ve tried to hire a plumber, handyman or other tradesperson recently, you likely aren’t surprised by this. The demand for people who are good at physical tasks is so strong we’re now hearing reports of housekeepers in wealthier areas earning $150,000 per year. That’s more than a first-year investment banker makes!

And since these workers spend a larger portion of their income on goods and services in what you might call the “real” economy, this has been great news overall. It’s a big part of the reason why the S&P 500 is up over 50% in less than two years.

How to Invest as the “Real” Economy Grinds Higher

Here’s the takeaway for us as investors: We’re not too late to buy into this growth. And if you’ve booked a nice gain in the last couple of years, now is a great time to turn that upside into income.

The key is to do this through closed-end funds (CEFs).

We love CEFs chiefly because of their large income streams, which average 8.3% today. That amounts to $680 per month for every $100,000 invested, which is incredible when you realize the stock market gets you just a bit over $100 a month for the same amount. But nowadays we’re especially focused on CEFs’ outsized discounts to net asset value (NAV, or the value of their underlying portfolios).

Across the board, CEFs are now at an average 6.7% discount, and here’s what most folks don’t realize about that figure: It results in a yield on NAV of 7.8%, or what management needs to earn to get us that 8.3% payout, which is based on the discounted market price.

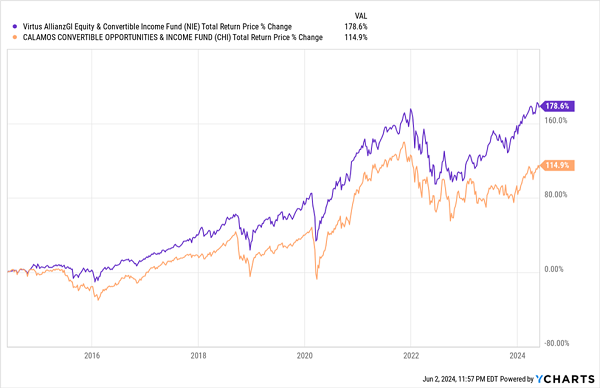

That 6.7% discount is actually a bit smaller than the longer-term CEF average, but that’s mostly because of a skew resulting from about 15% of the CEFs tracked by CEF Insider that boast absurdly high premiums to NAV, like the Calamos Convertible Opportunities and Income Fund (CHI), which trades at a 15.9% premium, mainly because investors are drawn in by its 10% yield.

Add to that the fact that CHI’s dividend hasn’t been cut since the 2008/2009 Great Recession and the thirst for this fund makes a lot of sense.

But not everything is rosy at CHI. There’s that premium, for one—you’ll need to pay about $1.16 for every $1.00 of assets in CHI’s portfolio. Compare that to the Virtus Equity & Convertible Income Fund (NIE), whose shares trade for 10% less than their assets are worth, so $1.00 of assets here costs just $0.90.

Everyone likes a good deal, but NIE isn’t better just because it’s cheaper. It’s also better because it has a stronger performance history.

Discounted NIE Outruns Overpriced CHI

If you’d put $100,000 in NIE a decade ago, you’d now have $278,600, while CHI investors would have $214,900, over $60,000 less.

What about income? NIE’s 8.9% dividend yield isn’t as generous as that of CHI, but it’s still huge, getting us $745 at a monthly pace per $100,000 invested, plus strong total returns.

Of course, both funds (and plenty of other CEFs) are money-makers now that stocks are likely to keep rising thanks to the strong labor market—particularly for workers we see out there every day in America. And while many “ho-hum” CEFs will still get us a solid income stream in an environment like this, the best ones will get us 8.9% yields, like NIE, and stronger gains, too.

Cheap CEFs Abound! Start With These 4 AI Funds Dropping Rich 8.1% Payouts

As we just discussed, our shot at profiting as the market turns against the doom-and-gloom crowd goes well beyond NIE. It extends to every corner of the CEF world, including a space you might not expect: artificial intelligence!

That might sound surprising, given the run AI stocks have been on lately. But that’s the beauty of CEFs’ discounts to NAV: They effectively let us buy the stocks these funds hold at prices we last saw weeks—and even months—ago. And CEFs let us grab a big slice of our return in safe dividend cash too.

So it is with the four AI funds I’m recommending now. They pay 8.1% dividends on average and hold all the top AI names, including Microsoft (MSFT), Alphabet (GOOGL) and more.

Best of all, thanks to these four CEFs’ big discounts, we can buy for much less than we’d pay on the stock market.

This post originally appeared at Contrarian Outlook.

Category: Cheap Dividend Stocks