Your Retirement Playbook: How Much You Need + 3 Big Dividends To Get There

Let’s go ahead and use the quickest, most reliable strategy I know of to kickstart a reliable 7% income stream that rolls our way every month.

My specialty is writing about stocks, bonds and closed-end funds (CEFs), but all of these are really a means to the end of achieving financial independence. What really matters is how much income you can pull out of these investments to fund your lifestyle.

The answer is a lot more than you might imagine. I’m going to show you how to pull 7% out of three funds that pay monthly and offer diversified income streams based on bonds issued by large, well-established companies (think of this portfolio as being like a big commercial bank, but one diversified across the world).

With that income stream, you can get $5,000 a month in income with less than a million dollars invested. If you don’t need that much, great. You can save the extra income as a cushion and spend as if you’re just getting a 6% average yield.

Need more? There are CEFs with even bigger yields, so we can do that, too.

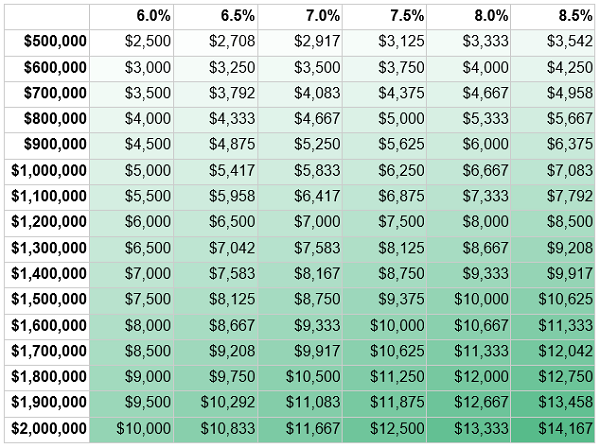

Your Guide to Monthly Passive Income

If you want to know if you’re ready to retire or not, the chart above can be a useful guide. Find how much money you want in passive monthly income, then find the amount you need to save (the left-hand column) and the percentage income you can get in the top row. That’s your target for how much money you need and what yields you need to get.

Let me show you how this works with an example.

Modeling a 7%+ Portfolio

We’re going to build a portfolio of bonds and loans to large companies because we want reliable income that doesn’t depend on volatile stock moves. As a result, we’re going to get a lower yield and lower total returns than we would with other CEFs, but we aim to get stability and reliable income in exchange.

And because these funds pay monthly, this is basically replacing a paycheck.

We’ll start with a CEF called the Advent Claymore Convertible & Income Fund (AVK), which focuses on convertible bonds—an asset that pays out regular income but can also be converted to equity in the company if certain conditions are met. This gets us regular cash in the door every month, plus potential upside.

Also, AVK trades at an 11.1% discount to net asset value (NAV, or the value of its portfolio) , which gives us some extra cushion—there’s a limit to how far CEF discounts go, and AVK has averaged about 10% over the long haul.

The world’s largest asset manager, BlackRock, will give us our second monthly payer, the BlackRock Income Trust (BKT). The fund owns a collection of debts, so it gets income from its creditors, which at the moment mainly consist of the US government. That’s pretty safe, which is why this fund’s 3.5% discount to NAV is relatively meager—its income stream is simply too reliable to sell for too cheap.

Finally, we’ll add the Cohen & Steers Limited Duration Preferred and Income Fund (LDP). Like AVK’s convertible bonds, LDP’s portfolio is a collection of debts that have equity upside, but in LDP’s case, these assets are mostly preferred stocks issued by large banks such as Wells Fargo (WFC) and Bank of America (BAC), as well as insurance companies like MetLife (MET) and the Hartford Financial Services Group (HIG). LDP’s 6.9% discount is a nice “goldilocks” deal between our other two funds.

These are all safe income sources, given these funds’ assets are diversified among hundreds of companies. Not only have these funds’ income streams remained intact for two decades, but the CEFs themselves survived the subprime-mortgage crisis, the low interest rates of the 2010s, a pandemic and post-pandemic inflation and rate hikes.

If you want reliable monthly income, it’s hard to imagine where else you can go to get 7%. Except for one thing: this portfolio doesn’t actually yield 7%. It yields 10.2%, which is much more than even the 8.5% yield at which the table above maxes out, so let’s update that:

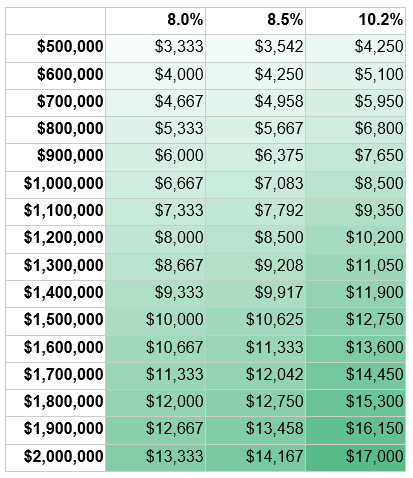

Your Monthly Income, With a 10.2% Yield Added On

Now we need just $600,000 to get our $5,000 per month in passive income.

Bear in mind that I wouldn’t necessarily recommend relying on that 10.2% forever, even with these low-risk funds—the future is unknowable, after all. But even if we assume a 21.5% drop in income in the next year, we’ve still got $4,000 per month in passive income with only $600,000 invested.

And a drop like that really would be unprecedented. Thanks to plenty of special dividends over the years (and relatively stable regular dividends, which have drifted 6% lower on average since 2012), these funds’ overall payouts haven’t gone down in the last decade. They’ve actually gone up a bit.

If you want to be very conservative and plan for just 7% dividends from these funds (assuming payouts will be slashed by a third), you could do that, but that seems way too cautious to me. In any case, no matter how you approach it, just this simple three-fund portfolio demonstrates just how powerful monthly-paying high-yield CEFs can be.

How to “Road Test” My CEF Advisory for 60 Days, Starting Now

With the holiday season in full swing, I wanted to invite you to try my CEF Insider service, whose portfolio of carefully selected CEFs yields 9.2% on average today, for 60 days with no obligation whatsoever.

Here’s how my offer works: click right here and I’ll give you a full investor briefing on CEFs, and how one indicator—a CEF’s discount to NAV—can generate big upside to go along with these funds’ 7%+ yields.

Then I’ll give you the opportunity to download a FREE Special Report on 4 of my top CEF picks now (current yield: 9.9%) and start your 60-day trial to CEF Insider.

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks To Buy?